Written for Charity How-To by Steve Latham, co-founder and CEO of DonateStock

September 2023

While cash may be tight, stock gains are widely dispersed, representing billions in potential funding for nonprofits. Unlike in the past, stock gifting is now accessible and easy for nonprofits of all sizes. Here is a 3-step plan for unlocking this massive source of funding.

After charitable giving’s first down year in more than a decade, the 2023 outlook for fundraisers is limited by persistent inflation and concerns about the health of the economy. Now more than ever, nonprofits need to re-think fundraising strategies and explore ways to diversify beyond cash, checks, and credit cards.

Appreciated stock represents billions in untapped funding as 50 million households own $30+ trillion in stock, ETFs, and mutual funds. To date, these assets have been inaccessible for all but the largest nonprofit organizations; small nonprofits have been largely excluded. But even among those who can accept stock gifts, stock rarely comprises more than 1% of proceeds due to the painstaking manual process for donors, financial advisors, and the organizations they support.

The good news is that the hassle associated with initiating and processing stock gifts is now a thing of the past. Like “PayPal for stock gifting” one solution to add to your fundraising tools is DonateStock’s Easy Button – this makes stock gifting a breeze!

What used to take donors and their advisors hours to do, can now be done in minutes. Moreover, donors can now tap into their investments (where 90% of financial assets are concentrated) rather than their credit cards or checking accounts to support the causes they love.

Below are screenshots of the donor experience.

Stock gifting is also now accessible and efficient for nonprofits of all sizes – no brokerage is required. Gone are the days of having to explain the process to each donor, share sensitive account information with strangers, investigate unknown donations, and manually reconcile and acknowledge gifts. Through software automation, transparency, and efficiency, stock gifting is equally available to nonprofits of all sizes.

In cases such as World Central Kitchen, “if you make it easy for supporters to donate stock, they will.” In just 12 months another client of DonateStock, WCK saw stock gifts jump from just over 1% of proceeds to almost 9% while improving donor satisfaction without burdening their staff.

For WCK and thousands of other organizations, DonateStock will facilitate, reconcile, and acknowledge the gift, liquidate the stock, and send the proceeds directly to the nonprofit in days (not months). Best of all this is now available to nonprofits of all sizes and budgets.

Unlocking stock gifting in 3 steps

To diversify and grow your fundraising program, just follow these three steps.

- Register your nonprofit by claiming your free page at Donatestock.com.

If your nonprofit is in good standing with the IRS, your page already exists on DonateStock! Just search our site and claim it by registering at no cost. You can get started in 15 minutes with no upfront or fixed costs – this is only a charge which is abelow-market transaction fee.

- Add a DonateStock button and educational content to your website.

Everything you need is provided in your DonateStock portal so you can inform and educate your donors on tax-advantaged ways to give.

Implement your DonateStock button on your “Ways to Give” and “Donate” pages. By featuring stock as a prominent giving option, you can convert $500 cash gifts to $5,000 stock gifts. Below is an example of how World Central Kitchen features stock gifting.

- Inform your board and your donors that stock gifting is now fast, safe and free.

As seen in numerous examples where organizations – large and small – have seen five and six-figure stock gifts simply by emailing and socializing to their supporters. The content and imagery is provided for you. Simply copy, paste and edit to match your tone and voice. Below is an example:

Dear [Donor Name],

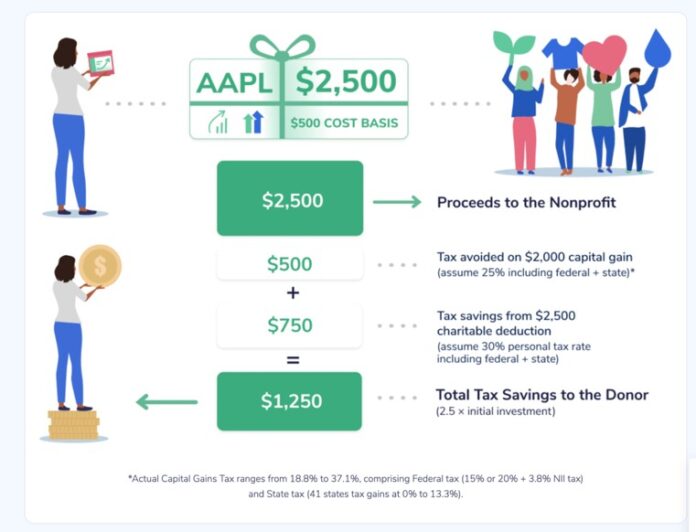

We are excited to announce a new way for you to make a bigger impact while saving more when you support our mission. Did you know that when you donate appreciated stock, you can avoid capital gains tax while deducting 100% of the value of the contribution? It’s a win-win for you and us. And now it’s fast, safe, and free to give smart and save more. As shown in the example below:

Still not convinced?

If you still need more evidence, just remember that happy donors make recurring gifts. In just two years, 20% of our stock donors have made subsequent gifts to the causes of their choice with an eye-popping average of 3.5 gifts (averaging $6,000 in stock gifts) per repeat donor.

To learn more please utilize these resources:

- Download our Onesheet for Nonprofits

- View our World Central Kitchen case study

- Download our Ultimate stock gifting guide for Nonprofits

- Read 3-steps for success: promoting stock gifting to Donors

- View our Partners page to see if we integrate with your fundraising platform

- Register your nonprofit at no cost

If you have questions or would like to learn more, please Donatestock.com.

About DonateStock: At the intersection of Fintech and philanthropy, DonateStock is transforming charitable giving by making stock gifting easy and accessible to millions of nonprofits and donors. DonateStock streamlines the stock gifting process to help donors make tax-advantaged stock gifts in minutes. Organizations benefit from larger pre-tax gifts along with the tools, automation and support to launch and growth their stock gifting programs.